For years, the Association of British Insurers (ABI) campaigned for those reaching retirement to shop around to find a better annuity rate. Retirees were ending up with poor value incomes as their personal circumstances had not been taking into consideration by their existing providers. The ABI finally got some traction with an agreement from lenders to include a statement within ‘wake up packs’, encouraging those approaching retirement to explore the open market.

So what happened when George Osborne decided to declare in March 2014 ‘let me be clear, no one will have to buy an annuity’? Well, people took this as an instruction not to buy an annuity and either take all their money out, or going into the other main retirement product, income drawdown.

Income drawdown is a little more complicated than annuities however, and very difficult to compare one provider against another. The main areas to consider are:

- Charges, ongoing and set up

- Fund access, is this a limited or wide range of funds?

- Service, do they give online access etc?

- Managed portfolio services, do they have ‘in house’ pre-built and managed portfolios?

With so many things to think about, someone new to drawdown is going to be easily overwhelmed. This brings us back to the annuity issue we had for so many years. Many people are simply sticking with their existing provider rather having to learn about the finer details of how income drawdown works.

Sam Broadbeck in Money Marketing highlighted this issue back in February,

“the FCA’s retirement income market study focused on making it easier for savers to shop around for the best priced annuity, not drawdown, prompting warnings that providers could look to use drawdown as a profits “honey pot” following the decline in annuity sales post-Budget”

The type of income drawdown provider you use is dependent on how you wish to withdraw your pension and what features you’re looking for. If you’re just looking at price, there are definite saving to be made. The Lang Cat, a highly respected, financial services consultancy company who monitor and review platforms from across the market, have recently named and shamed the least competitive platforms. Interestingly Standard Life are in there.

There are other larger life companies, from my own research, whose charges are above market average. There is a sense that these providers know how difficult it is for the man on the street to compare services, and as a result, expect their clients to stick with them in retirement.

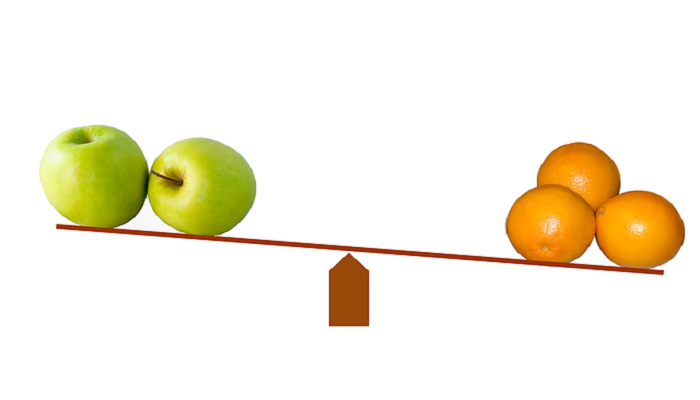

We seem to have the same issue with drawdown as we had with annuities where people are just being ‘rolled over’ into drawdown. That is unless you’re with a company which doesn’t offer it, such as Friends Life or Sun Life Financial of Canada.

Drawdown in its current form is difficult to compare, but shopping around provides definite advantages when you decide what features you want. Why pay for and all singing all, all dancing proposition, when you’re just looking to take your funds out in a tax efficient manner. Equally, don’t be stuck in a plan which restricts your investment choice if you want to have the best opportunity for fund growth. Decide what you want to achieve from your pension fund and what important to you before accepting your existing providers proposition.

Leave A Comment