Company Overview

AJ Bell is an investment platform founded in 1995 and provides online investment accounts and stockbroker services to retail investors and financial advisors.

- As of 2023, AJ Bell manages over £70 billion in assets under administration.

- It has 491,000 investment customers and 26,400 financial advisor clients.

- AJ Bell administers investments in SIPPs, ISAs, general investment accounts and more.

- AJ Bell has succeeded in attracting assets from competitors through its low-cost pricing model and customer service reputation.

- It has won awards for its investment app and platform innovations like ready-made investment portfolios.

- AJ Bell aims to make investing more accessible for consumers through technology and transparent fees.

Our Ratings

Pros

Great MPS

Excellent CS

Very Competitively Priced

Cons

Cheaper Platforms Available

Fund Access

AJ Bell SIPP

AJ Bell offers competitive access to a SIPP with an clear charging structure

Custody Charge – Payable monthly

- Shares custody charge: 0.25%

(max £10 per month) - Funds custody charge:

First £0 – £250,000 0.25%

Next £250,000 – £500,000 0.10%

Value over £500,000 No charge

Funds and Investment Options

Risk Targeted Funds

AJ Bell is largely aimed at the Do-it-yourself investor, but who also needs a little help filtering the funds.

To aid this they have six prebuilt funds designed for growth, a responsible growth option and two income fund options.

Favourite Funds

AJ Bell also offer a ‘favourite’ fund list which helps you screen fund from all the main sectors such as UK Equity, Europe, North America, Japan, Asia, Property, Global bonds etc. Their

The breadth and depth of AJ Bell’s investment offerings, including a variety of funds, shares, ETFs, and investment trusts catering to different asset classes and risk profiles, allows retirees to tailor their drawdown strategies to their unique financial objectives and risk tolerance.

Website and App

One of the main attractions to AJ Bell and the reason it’s one of the UK’s largest investment platforms is technology interfaces.

Website

Their website has a clean, modern design that is intuitive to use. The layout is well-organized with accounts, investments, and tools easily accessible from the main menu.

As you’d expect from a leading investment platform, the website provides detailed portfolio overviews, charts and analysis tools. These allow you to visualize your asset allocation and performance.

Some highlights of the website experience:

- Easy to find your account information and asset valuations.

- Fund research centre helps you analyse and compare investment options.

- Webchat customer support feature for instant assistance.

Overall the AJ Bell website design enhances usability for investors. The user interface is polished and accessing key information is seamless.

They have app’s on IOS and Android which offer similar simplicity and uncluttered nature.

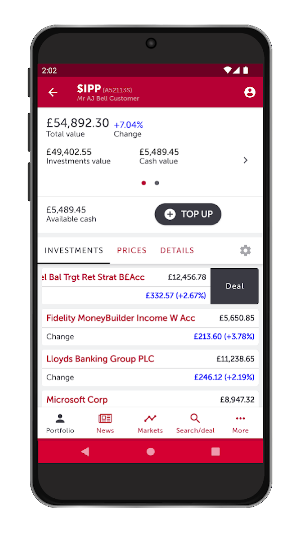

Mobile App

The AJ Bell mobile app effectively extends the web experience to your phone or tablet. The app allows you to check balances, buy/sell investments, and make withdrawals on the go.

The AJ Bell mobile app mirrors the website’s clean visual design. Portfolio tools and fund research capabilities are optimized for the smaller screen.

Some notable mobile features:

- Face ID/Touch ID login for quick secure access.

- Notifications for account activity and price alerts.

- Useful market news feed with videos.

Account Opening

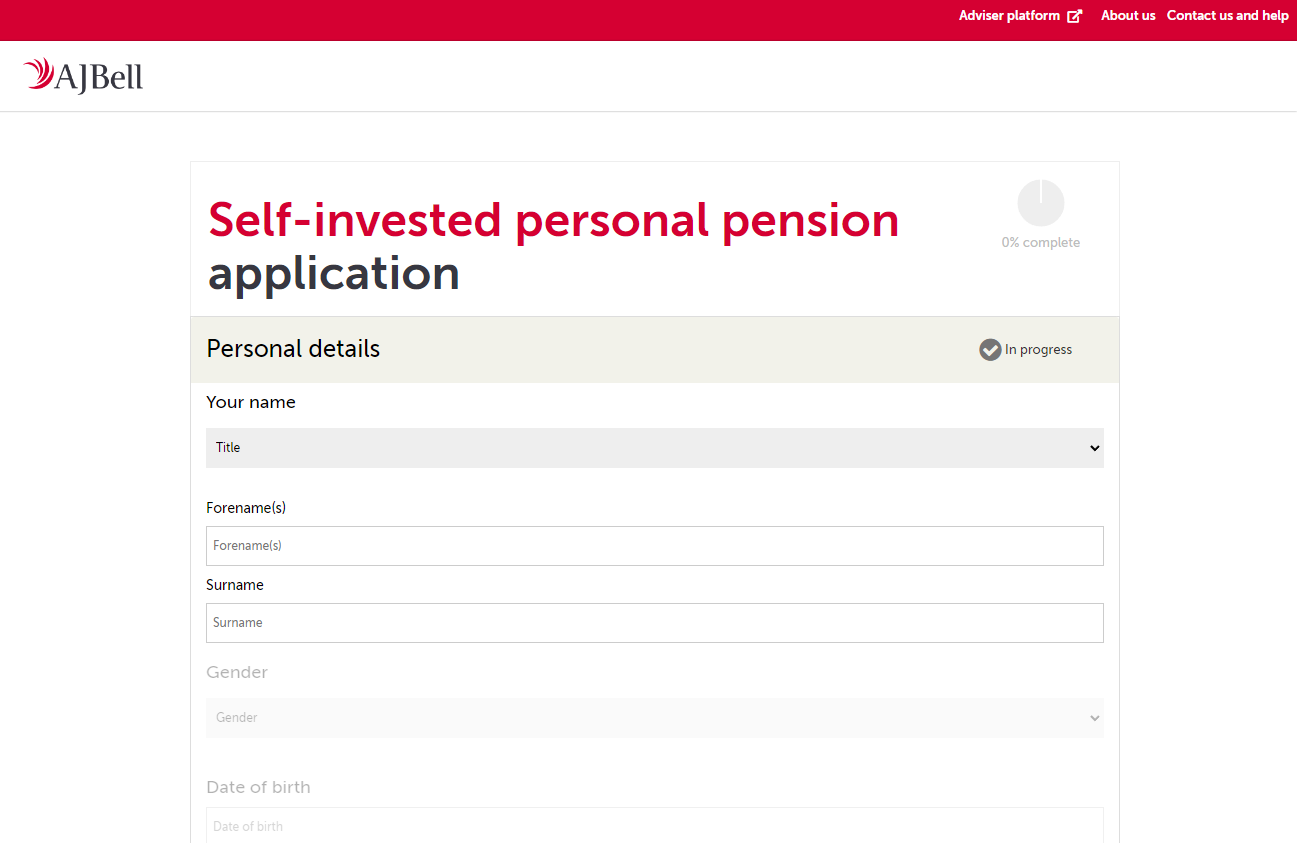

The Application Process

- You can start your application easily online. AJ Bell has an online form that covers all the required personal and identity details.

- The application asks details like your name, contact info, National Insurance number, and employment status. Filling everything out takes around 15-20 minutes.

Verification and Activation

- After submitting the application, you’ll received an email from AJ Bell within 1 business day.

- To activate the account, you need to provide proof of identity and proof of address.

- The account will then fully opened and be activated within 2 business days of completing the application.

Depositing Funds

- You can deposit funds via bank transfer or Cheque. AJ Bell provides their bank details for direct transfer.

- The funds usually clear and show on the account within 2 business days.

Transferring Funds

- If you’re transferring pensions from another provider AJ Bell will do all this for you. You need to provide your existing pension scheme number(s) and complete any discharge paperwork. After that the time it takes is down to your existing scheme as AJ Bell will process their forms within days.

Customer Service

AJ Bell offers phone, email, and live chat support options. In our experience they have one of the best customer service departments of all the providers. Their staff are knowledgeable, explain in a clear way and can usually resolve issues/answer questions quickly.

Call Wait Times

We tested each provider by calling them at three different times throughout a working week and took the average to illustrate their customer service wait times.

Tell us what you think of AJ Bell

Leave a Review

Reviews

-

Good Company

Very good company who answer the phon epon etime and have a great seledction of funds. Would jhighly recommend them to someone else.

Very good company who answer the phon epon etime and have a great seledction of funds. Would jhighly recommend them to someone else.

Was this review helpful?YesNoFunny