[vc_row][vc_column][vc_column_text]If you’ve opted for drawdown with your pension fund it’s an unnerving time at the moment. Globally, billions have been wiped off market values and if your invested, you’ve probably not wanted to check your fund values recently.

Many markets have reached ‘bear’ territory, which means an adjustment of 20% or more downwards since their peak.

Although many portfolios will be diversified, this type of systemic risk, means avoiding declines is virtually unavoidable.

There are some investment funds available which are gear up to deal with exactly this situation however.

Fund managers realise that those entering drawdown are nervous of times such as these, which is why there are options to invest but with some downside protection.

Investec run a Multi-Asset Protector II Fund. The Investec Multi-Asset Protector Fund aims to provide attractive, long-term returns, with the added benefit of downside protection. A multi-layered investment approach:

The Fund aims to grow your investment over the long term and provide protection (the minimum amount you can expect to get back from your investment) at 80% of the Fund’s highest ever share price.

The Fund invests around the world in a wide range of investments. These include shares of companies (up to 85%); bonds (contracts to repay borrowed money which typically pay interest at fixed times issued by governments or companies); property; commodities; cash (up to 100%); and other eligible asset classes.

The Fund aims to provide the 80% protection by gradually switching from the investment portfolio to a cash portfolio when markets fall.

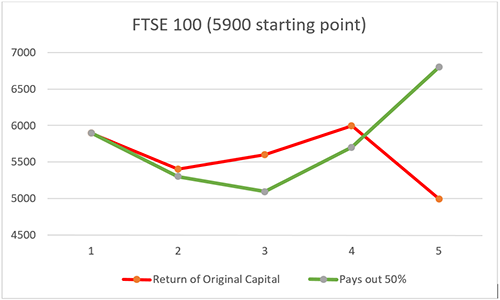

The graph below shows how the protection might work over time.

Source: Investecassetmanagement.com

Capital Guarantees are offer by Aegon and The Prudential. These type of funds are invested in global stock markets but offer a guaranteed of original capital, less any income taken, at the end of specific terms.

The term could be set for 10 years, for example, which means that if markets are down at that point, original capital value will be returned.

This type of guarantee would ease worry in period of shorter term volatility, however do lock you in for the full term, if you want to exercise the guarantee.

There is also an extra cost for the guarantee, which will affect growth during the term.

Axa Life Invest offer a range of funds which automatically de-risk in volatile markets.

Each Fund in the Global Strategy range has a specific tolerance for the level of movements in investment markets (called the volatility target level), which is designed to meet the needs of investors with different risk profiles.

If the target level for a Fund is exceeded, then AllianceBernstein quickly decrease the Fund’s exposure to more “risky assets“ (e.g. equity-based investments, government and corporate bonds) and increase their exposure to less volatile assets such as short-term government bonds.

To ensure you don’t miss out on potential growth opportunities, the Funds will return to the allocation of your chosen Fund when the volatility in the market falls back below the target level for that Fund.

These funds generally outperform conventional funds when volatility is high, and under perform them when volatility returns to normal.

Structured Products

This type of investment usually has a fixed term and promise to pay a return based on the performance of an indices. For example, they might promise to pay 50% return if the FTSE 100 is higher than the starting point at the end of a 5 years. The downside means you may just get back your original investment and therefore will have lost real value through inflationary risk.

In this example with the FTSE starting at 5900 points, the red line would return your original investment and the green line would return your original investment, plus 50% growth.

There are many different ways structured products are constructed but for the most part, they aim to protect your original investment if markets are lower at the end of the term. (Some investments might not offer protection if, for example the FTSE has gone down more than 50%).

There are hundreds of funds out there which aim to manage volatility and the risk of significant movement. The same strategy runs through them all, diversification. If equity markets are moving significantly, there may be safe havens in bonds or commodities.

If the recent turmoil has left you unnerved about whether drawdown is the right option, you may want to consider alternative retirement income options. Capital is nearly always at risk with investment and if you can’t afford a drop in fund value, it might not be right for you. Speak to an independent financial adviser if your unsure.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_btn title=”Drawdown Advice” link=”url:https%3A%2F%2Fwww.comparedrawdown.co.uk%2Ftalk-to-us%2F||”][/vc_column][/vc_row]

Leave A Comment