Retirees in the UK are increasingly rediscovering the appeal of annuities – financial products that convert pension savings into a guaranteed income for life. After several years of decline following the 2015 pension freedom reforms (which removed the requirement to buy an annuity), annuities are making a comeback. Improved market conditions and policy changes have aligned to boost annuity rates and sales. This article explores why annuities are regaining popularity, covering the role of rising gilt yields, recent upticks in annuity purchases, the benefits of locking in current rates, and the enduring advantages of a guaranteed lifetime income. Throughout, we maintain an educational tone to help you understand the trends and encourage you to consult a financial adviser about your retirement income options.

Rising Gilt Yields Drive Annuity Rates Higher

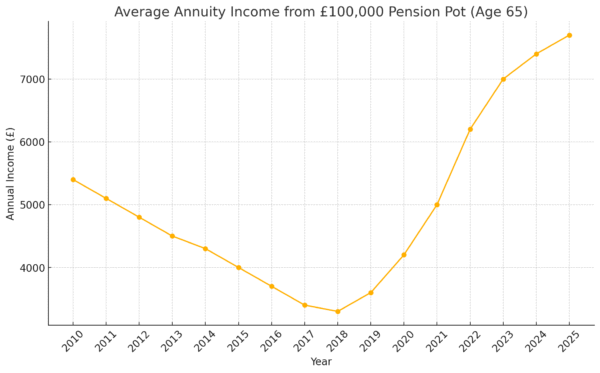

Average annual annuity income (for a £100k pension pot, single life level annuity at age 65) from 2008–2025. Annuity payout rates hit historic lows around 2016–2020 but have since surged to their highest levels in over a decade by mid-2025, closely tracking the rise in UK gilt yields.

One of the biggest reasons behind annuities’ renewed appeal is the sharp increase in UK government bond (gilt) yields over the past couple of years. Annuity providers invest heavily in bonds, so the income rates annuities can offer are closely linked to long-term interest rates and gilt yields. When gilt prices fall and yields rise (as has happened recently), insurers earn higher returns and can offer much better annuity payouts to retirees. In fact, gilt yields surged to their highest level since 2008 in early 2025 – a dramatic jump that has translated into the best annuity rates seen in over a decade.

The numbers tell the story. Annuity rates have roughly doubled from their pandemic-era lows, thanks to the higher yield environment. For example, the average annuity rate for a healthy 65-year-old was around 4.7% per annum in mid-2020, but by May 2025 it had rebounded to about 7.7% – a 64% increase in payout rate. In practical terms, a £100,000 pension pot could only buy roughly a £4,700 yearly annuity income at the 2020 low point, whereas today that same pot would secure about £7,720 per year for life. According to Standard Life’s annuity tracker, a 65-year-old with a £100k pension can now lock in approximately £7.7k annual income, versus barely £5k a few years ago. This surge in annuity rates is directly driven by the higher long-term interest rates and gilt yields in the market.

Importantly, these elevated annuity rates mean current retirees can secure a level of guaranteed income that hasn’t been available for many years. As Pete Cowell, head of annuities at Standard Life, noted, today’s environment offers “one of the strongest opportunities yet for securing a guaranteed income in retirement,” thanks to the rise in yields. In short, rising gilt yields have rejuvenated annuities – making the payouts far more attractive than they were during the ultra-low interest rate era of the 2010s.

Annuity Sales Surge as Retirees Seize the Opportunity

It’s no surprise that with payouts up so dramatically, many UK retirees are taking a fresh look at annuities. In fact, annuity sales have climbed rapidly in the last two years, reaching levels not seen since before the 2015 pension changes. As one analyst put it, this trend is a “reversal of fortune for a market that many thought had been all but killed off by a combination of rock-bottom interest rates and the [Freedom and Choice reforms]”. In other words, annuities – once thought outdated – are back in demand now that the rates on offer are much improved.

Recent statistics confirm the resurgence. According to the Association of British Insurers (ABI), 2023 was a milestone year for annuities. Total annuity sales that year reached £5.2 billion, a 46% increase over 2022, and about 72,200 annuity contracts were sold (34% more than the prior year). This was the highest annual annuity sales value since 2014 – essentially the strongest year since the pension freedom reforms were introduced. Importantly, it wasn’t just one good year: 2024 saw another leap in demand, with around 89,600 annuities purchased (up 24% from 2023), representing a new ten-year high in sales volume. The total value of annuities sold in 2024 hit approximately £7 billion, which is 34% higher than in 2023. In the words of the ABI, these “strong sales reflect rising interest rates as more people looked to secure a reliable retirement income for life”.

This renewed interest indicates that retirees are taking advantage of today’s favorable annuity rates to lock in guaranteed income streams. The ABI noted that 2023’s spike in purchases reflected a “strong consumer desire to lock in a guaranteed income for their later years”. In other words, after years of shying away from annuities, tens of thousands of people are now opting for the certainty of a lifelong, fixed income over other more volatile retirement options. It’s also telling that many shoppers are comparing providers to get the best deal – in 2024, about 69% of annuity buyers chose an annuity from a different provider than their pension provider (up from 64% in 2023). This suggests a more active, savvy approach by consumers who recognize the value of shopping around for the highest payout.

Ultimately, the surging sales figures underscore that high annuity rates have made these products attractive again. What was once seen as a poor-value or even obsolete choice (when rates were very low) is now being embraced by a growing number of retirees seeking secure income in retirement. The combination of strong annuity rates and the promise of lifetime income is proving to be a compelling proposition.

Locking In Attractive Rates Before They Decline

Another reason annuities are popular right now is timing – many experts believe we are at or near a peak in annuity rates, and that those rates could soften in the future if economic conditions change. In other words, there’s a window of opportunity to lock in today’s high rates before they potentially decline, and savvy retirees are keen not to miss out.

The logic is straightforward: The Bank of England aggressively raised interest rates in recent years (to combat inflation), driving gilt yields and annuity payouts higher. However, if and when the Bank of England starts cutting interest rates, gilt yields will likely fall and new annuity rates could become less generous. Indeed, the bond market is already anticipating rate cuts. Analysts note that if interest rates come down, gilt yields are likely to follow suit, which would negatively impact annuity rates going forward. We have started to see some signals of this – for example, in late 2024 the Bank of England began its first rate reductions in years, and annuity rates briefly dipped before spiking again amid market volatility. The consensus, though, is that sustained rate cuts would eventually pull annuity rates down from their current highs.

Because of this outlook, many retirement planners suggest that “now may be the best time” to secure an annuity. As Lily Megson, policy director at My Pension Expert, explains, with base interest rates expected to continue falling, “some pension planners consider now to be the best time to lock in an annuity product” rather than waiting. In other words, today’s gilt yields and annuity offers are unusually high by historical standards – locking in a guaranteed income now can safeguard retirees against the risk of lower rates in the future.

It’s important to remember that annuity rates won’t necessarily crash overnight (and any future rates would likely still be solid by past standards). For instance, even if yields ease, industry experts feel annuity payouts are unlikely to fall back to their historic lows in the near term. Nonetheless, the current environment represents a “sweet spot” for annuity shoppers, combining high available income rates with the enduring benefit of lifetime guarantees. For retirees who are considering an annuity, the message is clear: taking advantage of the current peak in rates could lock in a higher income for life, providing peace of mind even if economic conditions shift down the road.

Benefits of Annuities: Certainty, Security and Longevity Protection

Beyond the numbers, annuities have intrinsic features that appeal to retirees who want financial security in their later years. The renewed interest in annuities isn’t only about chasing high rates – it’s also driven by a recognition of the unique benefits these products provide, especially in uncertain times. Here are some key advantages that make annuities attractive as part of a retirement plan:

- Guaranteed Income for Life: An annuity converts your pension savings into a steady, predictable paycheck for the rest of your life. This income is fixed (or increases in set increments, if you choose an inflation-linked annuity) and does not fluctuate with markets, so you know exactly what you’ll receive each month. This certainty can be invaluable for budgeting in retirement and insulates you from stock market volatility or investment downturns. No matter what happens in the economy, your annuity keeps paying.

- Protection Against Outliving Your Savings (Longevity Risk): Annuities are essentially insurance against longevity risk – the risk that you might outlive your pension pot. Because an annuity continues paying for as long as you live, it guarantees you won’t run out of income even if you live to 100 or beyond. In an era where life expectancies are rising, this feature provides tremendous peace of mind. You don’t have to worry about your pension fund running dry in your later years; the annuity has you covered for life.

- No Investment Management Stress: With an annuity, you eliminate the ongoing investment and market risks that come with drawdown or managing your own portfolio. Retirees often have less appetite for risk and may not want the stress of monitoring markets or the danger of a market crash derailing their income. Annuities remove that worry – they deliver reliable income regardless of economic fluctuations. This can reduce financial anxiety and simplify your retirement finances, especially if cognitive decline or health issues make active management harder in very advanced age.

- Optional Inflation and Spousal Protection: Many annuities can be tailored with features to suit your needs. For example, you can choose an escalating annuity that increases your income each year to help keep up with inflation, preserving your purchasing power. You can also opt for a joint-life annuity or add a guaranteed period, so that your spouse/partner or beneficiaries are protected and continue receiving income if you pass away before a certain time. These options mean annuities can be customized to provide not just for you, but for your loved ones or to account for rising costs. (Do note that adding these features will generally reduce the initial income rate.) Even with a basic single-life level annuity, however, the core appeal remains: a guaranteed payment for life that you can rely on.

All these benefits contribute to annuities’ renewed appeal in the UK retirement landscape. As Lloyds Banking Group’s retirement insights team summed up, annuities offer a “plethora of benefits such as guaranteed payments, protection against longevity risk, protection for dependants and potential for inflation adjustment,” making them an attractive option for many retirees. In essence, an annuity provides certainty and insurance against life’s uncertainties – your income is secured no matter how long you live or how markets perform, which can greatly enhance your financial peace of mind in retirement.

Other Factors Renewing Interest in Annuities

In addition to high rates and the inherent benefits of guaranteed income, a few other developments are contributing to the resurgence of annuities:

- Changes in Tax Treatment of Pensions: A significant policy change on the horizon is making annuities more compelling for certain retirees. In the Autumn 2024 Budget, the government announced that from April 2027, unused pension pots will become subject to inheritance tax (IHT). Previously, many people in drawdown kept their pension invested as a way to pass wealth to heirs tax-efficiently (since pensions could be left to beneficiaries largely tax-free, especially if the retiree died before age 75). With pensions coming into scope for 40% inheritance tax after 2027, that strategy is less attractive. This is expected to “remove many people’s rationale for using income drawdown… to pass the pension down generations”, according to commentators. Instead, more retirees – particularly those with larger pots who were holding off drawing their pension – may opt to use their funds to secure a guaranteed income through an annuity, now that the inheritance tax advantage of not annuitizing is being curtailed. In simple terms, if your pension can no longer be a tax-free inheritance vehicle, you might be more inclined to spend it on an annuity to ensure you enjoy it as income during your lifetime.

- Competitive Market and Innovation: The annuity market itself has become a bit more competitive and flexible. In the years after 2015, some insurers left the open annuity market, but now at least six providers actively offer annuities to new customers, and competition can lead to better rates for consumers. More people are also shopping around (as noted earlier), which pushes providers to offer attractive deals. Additionally, product features such as enhanced annuities (which pay higher income if you have certain health conditions or lifestyle factors) and value-protection options have evolved, giving retirees more personalized choices. This innovation and competition make the annuity proposition more appealing than it might have been a decade ago.

- Psychological Comfort in Uncertain Times: Recent economic and market turbulence – from the pandemic, to inflation surges, to stock market volatility – has highlighted the appeal of certainty. An annuity’s set-and-forget guaranteed income can feel like a safe harbor in a storm. Knowing that, for example, your basic living expenses are covered by guaranteed sources (State Pension plus an annuity) can provide a foundation of security. This psychological benefit of a worry-free income floor is another reason some retirees are re-embracing annuities. They can then invest any remaining funds more confidently or simply enjoy retirement without constantly checking the markets. As one retirement director observed, “Knowing that you have a guaranteed income for life can significantly reduce financial anxiety… allowing retirees to focus on enjoying their retirement years rather than worrying about their financial future.” In short, the peace of mind an annuity brings is a valuable feature driving renewed interest.

All these factors – higher gilt yields, rising annuity rates, looming tax changes, and the desire for financial certainty – have converged to put annuities back in the spotlight for UK retirees. It’s a case of the right product at the right time: annuities are offering solutions to some of the key concerns retirees face (low yields, longevity risk, market volatility), and people are responding accordingly.

Making the Right Decision – The Importance of Advice

While annuities are growing in popularity for good reason, deciding whether to purchase an annuity (and which type) is a major decision that should be made carefully. Annuities lock in your money irrevocably – once you buy one, you generally cannot change your mind or withdraw the lump sum. Thus, it’s crucial to evaluate if an annuity fits your personal circumstances, income needs, and risk tolerance. This is where speaking with a qualified financial adviser can make a world of difference.

Encouragingly, more retirees are recognizing the value of professional advice when considering annuities. Industry data shows that while historically only a minority sought advice, the trend is changing. In 2023, for example, only about 29% of annuity purchasers consulted a financial adviser beforehand, but in 2024 that figure rose to 36% of buyers getting advice before buying an annuity. In other words, over a third of people are now seeking guidance, up from less than a third the year before. That still means many are going it alone, but it’s a positive sign that advice is becoming more common – and it should be, given the complexity and importance of the decision.

A professional financial adviser can help you assess whether an annuity is right for you and, if so, how to structure it optimally. They will take into account your total financial picture: your essential spending needs (which an annuity could cover), your health and life expectancy, your desire to leave inheritance, and how an annuity would work alongside other income (like drawdown investments or State Pension). An adviser can also shop the whole annuity market on your behalf to find the best rate for your circumstances – often the difference between the best and worst annuity quote can be significant, so this can pay off substantially. Additionally, they can explain the trade-offs of options like level vs. increasing income, single vs. joint life, guarantee periods, etc., helping you customize an annuity that gives you and your family the most benefit.

Most importantly, getting advice can give you confidence in your decision. Annuities offer stability, but they are not suitable for everyone or for all of one’s pension savings. Some people may prefer to keep flexibility with drawdown, or use a combination of drawdown and annuities (for example, annuitizing enough to cover basic expenses and investing the rest). These choices are highly individual. By talking through it with a professional, you can ensure you understand all the implications and are comfortable with your plan. As the UK’s Financial Conduct Authority has noted, consumers often struggle with complex retirement decisions without advice. There’s no need to go it alone.

In conclusion, annuities are experiencing a renaissance among UK retirees – thanks to rising gilt yields delivering much-improved payouts, a strong desire for secure income in uncertain times, and external factors like tax changes nudging people back to guaranteed solutions. If you are approaching retirement or in early retirement, it’s worth taking a fresh look at what today’s annuities could offer you. With rates at multi-year highs, locking in a guaranteed income now can provide lifetime financial security and peace of mind. However, the decision is a big one and timing can be critical, so we strongly encourage you to speak with a financial adviser about your options. They can help you determine whether an annuity (or combination of strategies) makes sense for your needs, and guide you toward the best available rates and product features.

Retirement planning is all about ensuring you can enjoy your later years with confidence. For many UK retirees, the newly resurgent annuity – offering a dependable “paycheque” for life – is becoming an attractive tool to achieve that. By getting informed and seeking advice, you can make the choice that will keep you financially secure for the years ahead. Whatever you decide, the key is to have a plan for income that you feel comfortable with. And with the right guidance, you might find that today’s annuities can indeed provide the security and stability to help you live your retirement to the fullest.

Sources

- 2023 sets new post-pension freedoms record for annuity sales | ABI

- Another post-pension freedoms record for annuity sales | ABI

- Annuity rates surge above 7.7% – highest point of the decade | Standard Life

- Is now a good time to buy an annuity? | MoneyWeek

- Annuity rates in 2025: will UK gilt turmoil boost retirement income? | Fidelity International

- Unlocking financial freedom with annuities | Lloyds Banking Group plc

- Latest Gilt Yields | 15-Year Gilt Yields | SharingPensions.co.uk