As you approach retirement, it’s important to consider how best to take an income from your pension pot. A popular choice is Phased drawdown. It offers a flexible and tax-efficient way of withdrawing funds – but what is it exactly? And when should you start taking money out? Here we look at the advantages and disadvantages of phased drawdown so that you can make an informed decision on whether this option suits your needs. We’ll also explore when might be the right time for starting to withdrawing money from your pension pot.

Table of Contents:

- What is phased drawdown?

- How Does It Work?

- When Is the Best Time to Start Taking Income From Your Pension Pot?

- FAQs in Relation to What Is Phased Drawdown?

- Conclusion

What is Phased Drawdown?

Phased drawdown is a way of taking income from your pension pot over time instead of all at once. It can be used to supplement other retirement income sources like annuities or occupational pensions or just allow you to reduce your working hours and make the additional income required up through your pension. You can start withdrawing money from your pension pot whenever you want, as long as you’re aged 55 or over. The amount you withdraw each time is up to you – but remember that if you take out more than the tax-free allowance in one go, you’ll have to pay Income Tax on the rest.

There are some advantages and disadvantages to flexible phased drawdown, which we’ve outlined below:

Advantages:

- Tax planning: The ability to control the amount of tax-free cash and taxable income taken can help manage your income tax bill.

- Phased drawdown allows you to reduce the risk of your investment portfolio gradually over time, as opposed to selling all of your investments at once. This can reduce the impact market volatility has on your investments.

- Flexibility: Phased withdrawal allows you to tailor your withdrawal strategy to your specific needs and circumstances. You have control over the rate at which you sell your investments, as well as the order in which you sell them.

- If the market is performing well, phased drawdown enables you to take advantage of the potential for higher returns by continuing to hold onto a portion of your investments for longer time periods. Some people fall into the trap of taking all their tax-free cash as soon as they retire, even though they don’t have any need for it. That is a potentially large amount of money, held in cash, that may have done better by staying invested.

Disadvantages:

- Phased drawdown can be more complex than other withdrawal strategies because it requires careful planning and ongoing management to ensure that financial goals are met while the risk is managed.

- Depending on the investments you hold, your options for implementing a phased drawdown plan may be limited. For instance, if you hold a large number of individual stocks, it may be challenging to sell them in accordance with your phased drawdown strategy.

- There are many drawdown providers that don’t offer the facility of phased drawdown, so if you want to use this strategy, you’d need to move your pension.

- While phased drawdown can reduce the impact of market volatility on your investments, it does not completely eliminate market risk. The value of your investments may fluctuate significantly over time, which may have an effect on your overall financial strategy.

- If the market performs poorly and you’ve not taken all your tax-free cash, you could end up taking an overall lower amount than if you’d taken it all at the start.

Phased drawdown is a way of taking income from your pension in stages, allowing you to manage your income and income tax liability whilst hopefully taking advantage of the growth in the markets. re deciding when to access funds.

How Does It Work?

Phased drawdown is a flexible way of taking money from your pension pot. It allows you to take tax-free cash and income over time rather than all at once. This can be beneficial if you want to manage your income tax liability or top up other income to help in retirement.

Phased drawdown allows you to stagger your tax-free cash payments from your pension.

Take this example.

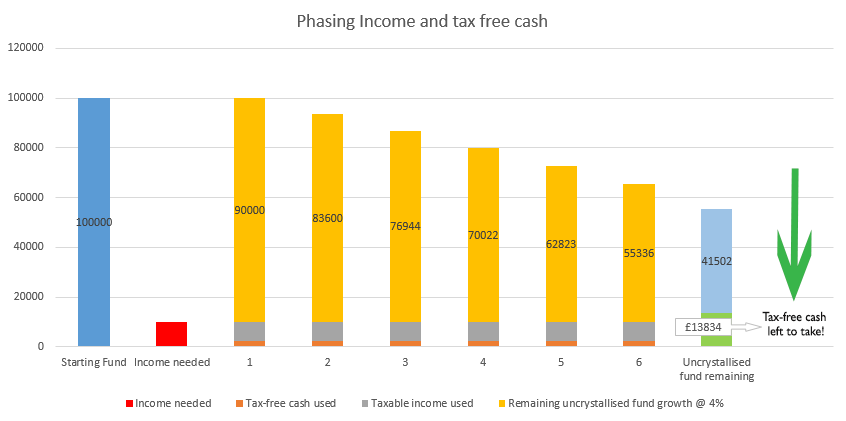

Mr Smith and Mr Jones want to retire at 60 and have the same £100,000 pension fund value. They need £10k per year income after they retire until their state pension age at 66 (£60,000 in total). Neither have any other pensions or taxable income once they retire.

Mr Smith crystallises his £100,000 pension fund. He’s allowed 25% (£25,000) tax-free. The remaining £75,000 is then moved (crystallised) into drawdown, which he can take further (taxable) income from.

Over the next six years, until his state pension age, he uses his £25,000 tax-free cash and a further £35,000 from his drawdown fund. As his £10,000 income requirement is below the nil rate band for paying income tax (currently £12,570 – 2022/23), he pays no tax on his drawdown income.

During this 6-year period, his fund grows 4% per annum.

When his state pension starts, this uses up all his nil rate band, meaning any further withdrawals from the crystallised drawdown will be subject to income tax.

He has no further tax-free cash to take, and all his future drawdown income is now taxable.

Mr Jones is in the same fund and retiring at the same time. He decides to use a phased drawdown technique.

Rather than take all his tax-free cash at the outset, he only crystallises £10,000 (his income needs) per year.

Of this £10,000, £2,500 is his tax-free cash, and the £7,500 is the taxable income part. Although, as he has no other taxable income, the £7,500 falls into his nil rate band and therefore isn’t taxable.

Just the same as Mr Smith, at 66, his state pension starts and uses all his nil rate band, meaning any further pension income will be taxable.

His fund has also grown by 4% per annum during this period.

The difference with this phased drawdown method is that Mr Jones has further tax-free cash to take as he didn’t crystallise all his pension on day one. By leaving some of his tax-free cash invested, it has grown at 4%, meaning a larger amount is now available to him.

In the above example, Mr Smith had a 25% (£25,000) tax-free cash entitlement which he took at the outset, meaning no further amount could be taken. However, Mr Jones will have £43,834 (6 x £2,500 plus the allowable £13,834 at the end) tax-free cash entitlement. Whereas Mr Smith used all his tax-free cash at the outset, Mr Jones took around 1-10th of his allowance each year for six years, meaning he had around 4-10th left to take.

They have both achieved the same income, but Mr Jones has significantly more tax-free cash left to take. As their state pensions use all their nil rate band, this is a significant advantage to Mr Jones.

The above example might be presuming an ideal scenario, but the concept is there. It’s worth noting that markets could also decline rather than rise at 4% per annum, which would have an entirely different outcome.

When Is The Best Time To Start Taking Income From Your Pension Pot?

This really depends upon individual circumstances; those who have an immediate income need don’t really have any choice. If you’ve reduced your working hours and need additional income or if you have other incomes such as an annuity or defined benefit scheme where the total income isn’t sufficient, you’ll need to start drawing an income straight away.

If you have other savings, such as cash or other investments outside of pensions, it may be a good idea to use some of these funds first before drawing down on your pension. Again it depends on your overall financial circumstances, but pension funds aren’t considered as part of your estate for inheritance tax purposes, so if you have a potential liability based on your property value and all other non-pension assets, you should look to use these for income initially. Spending your cash savings whilst leaving your pension to grow can reduce your overall Inheritance tax liability.

Another factor to consider when deciding whether to start taking an income from your pension is general market performance. If at all possible, it’s best to avoid drawing an income from your pension if the value has significantly reduced in recent months. This is because you will have to sell more units to provide the same income than in previous months, and it will be harder for your pension to recover once markets start to grow again.

FAQs in Relation to What Is Phased Drawdown?

What is the difference between Ufpls and phased drawdown?

UFPLS (Uncrystallised Funds Pension Lump Sum) and phased drawdown are two different ways of taking an income from a pension. UFPLS is a one-off lump sum payment taken directly from the pension pot, while phased drawdown allows you to take smaller amounts over time. With UFPLS, you can take up to 25% of your total fund as tax-free cash, but any amount above this will be subject to taxation. With phased drawdown, you can choose how much money you want to withdraw each month or year, and it will not be taxed until it exceeds your personal allowance. Both options have their advantages and disadvantages, so it’s important that individuals consider their own circumstances before deciding which option is best for them.

What are the different types of drawdown?

Pension drawdown is a way of taking an income from your pension pot while leaving the remainder invested. There are two main types of drawdown: flexible and capped. Flexible drawdown allows you to take as much or as little income as you like, up to the maximum amount allowed by HMRC each year. Capped drawdown limits the amount that can be taken each year, but it may still provide more than with an annuity. Both options offer tax advantages over other forms of retirement income, such as annuities, and both require careful consideration before making any decisions.

What are the disadvantages of a drawdown pension?

Drawdown pensions can be a great way to access retirement funds, but there are some potential drawbacks. Firstly, the value of your pension pot can go down as well as up, and you may get back less than you invested. Secondly, if you take out too much money in one year, it could affect your tax bill or even push you into a higher tax bracket. Finally, drawdown pensions require careful management over time, and they may not provide an income for life – meaning that when the pension pot runs out, so does the income.

Conclusion

In conclusion, phased drawdown is a great way to access your pension pot in a tax-efficient manner. It offers flexibility and allows you to withdraw funds gradually over time. However, it’s important to consider the advantages and disadvantages of flexible phased drawdown before making any decisions about taking income from your pension pot. Ultimately, the best time to start taking income from your pension pot will depend on individual circumstances and should be discussed with an experienced financial advisor who can help you make an informed decision that meets your needs.