Changes to Pension Death Benefits: What You Need to Know

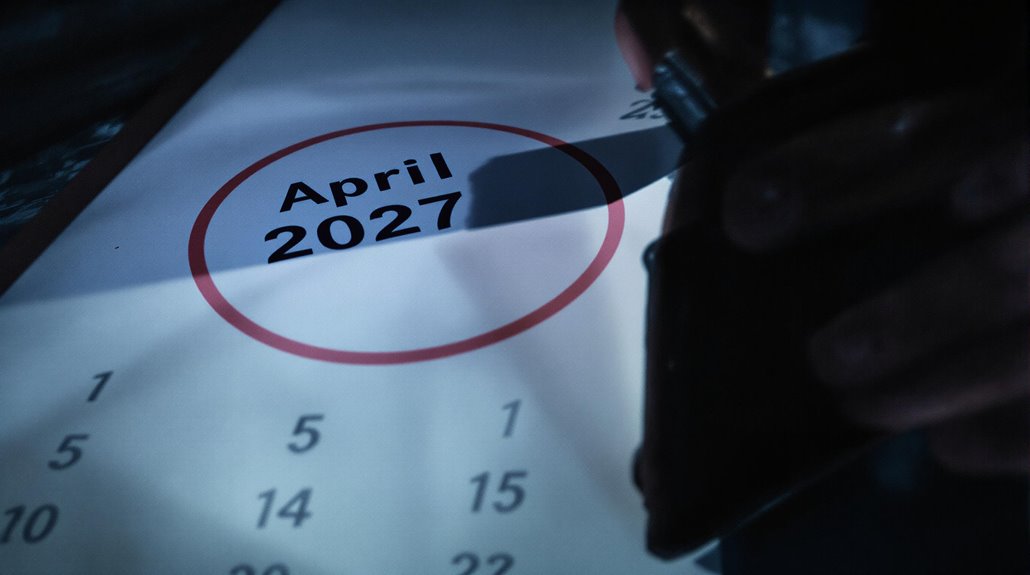

From April 2027, the treatment of pension death benefits is set to undergo significant changes. Currently exempt from Inheritance Tax (IHT), most unused pension funds and death benefits will be brought within the scope of IHT, potentially subjecting them to a 40% tax rate. This shift aligns with the government’s aim to restore the principle that pensions should not be used for accumulating capital sums for inheritance purposes, as was the case before the 2015 pensions reforms.

Meanwhile, the Lifetime Allowance was abolished in April 2024 and replaced with two new limits: the Lump Sum Allowance and the Lump Sum and Death Benefit Allowance. The Lump Sum Allowance is now £268,275, limiting the total amount of tax-free sums that can be received during a lifetime across all pension savings. The Lump Sum and Death Benefit Allowance is set at £1,073,100, covering tax-free sums and certain death benefits that are payable tax-free.

It is expected that these changes will have far-reaching implications for beneficiaries and estates. The inclusion of unused pension funds and death benefits within IHT could impact various situations, such as payments made to children, grandchildren, or other relatives who are not spouses or civil partners. Additionally, the changes could affect couples who live together but are not married or in a civil partnership.

For individuals with pension savings, understanding these new rules is essential. The abolition of the Lifetime Allowance and the introduction of IHT on pension death benefits necessitate careful consideration of pension planning strategies to optimise retirement and estate planning.

It is worth noting that not all pension death benefits will be included in the IHT changes. Dependants’ scheme pensions and certain charity lump sum death benefits will remain outside the scope of IHT, even after April 2027.

Given the complexity of these changes and their potential impact, individuals are encouraged to seek professional advice to ensure they are well-prepared for the new rules. The current consultation period for the IHT changes will run until 22 January 2025, providing further clarity on the implementation of these proposals.

Current Pension Death Benefits Rules

Pension Death Benefits in the UK: Understanding the Current Landscape

Pension death benefits play a significant role in estate planning, making it essential to understand the specifics to ensure that your arrangements are structured efficiently. In general, death benefits derived from pension funds aren’t included in your estate for Inheritance Tax (IHT) purposes. This principle means that lump sum death benefits and dependants’ scheme pensions don’t incur IHT upon death.

For individuals who pass away before the age of 75, lump sum death benefits aren’t subject to income tax if they’re paid within two years of the pension scheme administrator becoming aware of the death. Conversely, if death occurs at 75 or over, lump sum death benefits are taxable at the recipient’s marginal income tax rate.

Unused drawdown funds can be distributed either as a lump sum or used to provide a dependant’s pension. The tax treatment of these benefits depends on the age of the recipient and the deceased member at the time of death.

Dependents’ scheme pensions are treated as pension income in the recipient’s hands and aren’t subject to IHT.

The Lifetime Allowance (LTA) was abolished as of 6 April 2024. For benefits crystallised before this date, interim measures apply, which may reduce the new lifetime limits available for future benefits.

The taxation of death benefits is primarily determined by the member’s age at death and the type of benefit. From 6 April 2024, lump sum death benefits are tested against the available Lump Sum and Death Benefit Allowance (LSDBA). Any amount exceeding the LSDBA is taxed at the recipient’s marginal income tax rate.

From 6 April 2027, a significant change is anticipated: most death benefits paid from registered pension schemes will become part of the deceased member’s estate for IHT purposes, including lump sum death benefits and unused drawdown funds. This change underscores the importance of reviewing estate plans to ensure they continue to optimise tax efficiency.

Additionally, scheme administrators will be responsible for reporting and paying any IHT due on death benefits from this date5 April 2027.

It is essential for individuals to understand these rules to make informed decisions about their pension benefits and estate planning strategies. Given the complexity of these regulations, seeking professional guidance can help ensure that arrangements are structured to meet individual circumstances and objectives.

Changes to Inheritance Tax Rules

The upcoming changes to Inheritance Tax (IHT) rules on pension death benefits may necessitate a review of estate planning strategies. As of 6 April 2027, most pension death benefits will be included in the deceased member’s estate for IHT purposes.

This shift encompasses unused drawdown funds, lump sum death benefits (including uncrystallised funds lump sum death benefits and five-year guarantee lump sums), and benefits from defined contribution (DC) plans, which will be subject to IHT.

It is important to note that income tax will continue to be payable on lump sum death benefits if the member dies aged 75 or over, in addition to any IHT payable. This can result in a double tax hit for beneficiaries.

However, there are exceptions: dependents’ scheme pensions and charity lump sum death benefits will remain outside the member’s estate for IHT purposes.

The spousal IHT exemption remains unaffected, meaning transfers between spouses and civil partners continue to be free from IHT liability. The current nil rate band of £325,000 will still apply, allowing estates to pass on at least this amount without incurring IHT.

In light of these changes, it is crucial for pension scheme administrators to understand their new responsibilities, including their obligation to report and pay IHT liabilities.

In general, these changes could have significant implications for those who’ve been building up their pension pots with the intention of passing them on as part of their estate. It may be beneficial for individuals to review their current arrangements and consider how to optimise their financial plans in light of these forthcoming changes.

Understanding the impact of these changes and planning accordingly can help mitigate potential tax liabilities.

Impact on Beneficiaries and Estates

Impact of IHT Changes on Beneficiaries and Estates****

Significant changes are on the horizon for the taxation of pension death benefits, effective from 6 April 2027. These alterations will have a profound impact on both beneficiaries and estates, making it essential to grasp the new regulations.

Until now, most pension death benefits were free from Inheritance Tax (IHT) if the member passed away before their 75th birthday. Furthermore, these benefits generally fell outside the estate for IHT purposes.

However, post-April 2027, this landscape will shift. Most lump sum death benefits and unused drawdown funds will be included in the estate for IHT purposes. Additionally, income tax will still be payable if the member died at or after age 75 or exceeded the Lifetime Allowance.

An important exception remains for dependants’ scheme pensions, which will continue to be exempt from IHT, though subject to income tax at the recipient’s marginal rate. Payments to spouses or civil partners will also remain exempt from IHT.

For estates, the inclusion of pension death benefits in the overall IHT calculation represents a significant change. Scheme administrators will bear the responsibility of paying IHT on pension benefits, requiring close collaboration with personal representatives to accurately calculate and report this tax.

This shift places a substantial new administrative burden on scheme administrators and could increase the complexity of managing estates.

The new regulations will necessitate a reevaluation of estate planning strategies to optimise tax efficiency. It’s anticipated that the changes will encourage individuals to reconsider their pension strategies, possibly accelerating drawdowns or seeking alternative financial arrangements to mitigate the increased IHT liability.

From 6 April 2024, the Lump Sum and Death Benefit Allowance will also limit tax-free lump sums payable on death, with excess amounts taxed at the recipient’s marginal income tax rate.

New IHT Treatment for Pensions

The recent Autumn Budget has introduced significant changes to the inheritance tax (IHT) treatment of pension death benefits, which will come into effect from 6 April 2027. Under these new rules, the majority of unused pension funds and death benefits will be included in an individual’s estate for IHT purposes, regardless of whether they’re held in discretionary or non-discretionary schemes.

This change is likely to result in more complex estate planning and increased administrative responsibilities for scheme administrators. As such, it’s essential for individuals to review their pension and estate plans in light of these new rules to ensure they’re adequately prepared.

Key aspects of the new rules include the inclusion of lump sum death benefits and unused drawdown funds within an individual’s estate for IHT purposes, while dependants’ scheme pensions will remain exempt. The standard IHT rate of 40% will apply, and pension scheme administrators will be responsible for reporting and paying any IHT due on unused pension funds and death benefits.

To facilitate this process, HMRC is developing an online calculator to help personal representatives (PRs) determine the proportion of the IHT nil-rate band to be apportioned to each relevant death benefit. Additionally, a technical consultation is underway to refine the details of these changes and to gather feedback on the proposed processes for liability, reporting, and payment.

Given these pending changes, individuals are encouraged to reassess their pension and estate plans to optimise their financial arrangements and to mitigate any potential IHT liabilities. It’s anticipated that these changes will impact a significant number of estates, with HMRC forecasting that around 8% of estates each year will be affected.

The new rules will replace the current distinction between discretionary and non-discretionary schemes with a unified approach, ensuring all types of pension death benefits are taxed consistently standard IHT rate. This helps align pension savings with their original purpose of providing retirement income rather than inheritance for descendants.

Lifetime Allowance Explained

The landscape of pension regulations has undergone a significant transformation with the abolition of the lifetime allowance, effective 6 April 2024. Historically, the lifetime allowance imposed a cap on the total amount of pension savings that could be accumulated tax-free. However, this has been replaced by two new lifetime limits that focus specifically on the tax-free elements of pension savings.

The first of these new limits is the lump sum allowance (LSA), which restricts the amount of tax-free lump sums that can be paid to an individual during their lifetime to £268,275. Notably, this figure can be higher for individuals who hold valid lifetime allowance protections.

The second limit, the lump sum and death benefit allowance (LSDBA), is set at £1,073,000 and applies to lump sums paid upon death. Both allowances are subject to reduction by 25% of the lifetime allowance used before 6 April 2024.

It is important to understand that these new limits don’t impose a cap on taxable income from pensions. Therefore, individuals should familiarise themselves with these changes to ensure they’re making the most of their pension savings under the new rules.

Effective management involves understanding how these allowances work and how they’re impacted by pre-existing protections and previous use of the lifetime allowance.

Recent regulations, such as the Pensions (Abolition of Lifetime Allowance Charge etc) Regulations 2024, provide further clarification and technical amendments to ensure a smooth transition to the new framework. These include specifications for how lump sums and death benefits are treated and reported, as well as provisions for individuals with enhanced protection and those transferring to qualifying recognised overseas pension schemes (QROPS).

As these changes take effect, pension scheme administrators and members alike must stay informed about the implications of these new limits and how they may affect individual pension plans.

This includes understanding the rules around the payment of pension commencement lump sums (PCLS) and the treatment of specific protections and overseas service enhancements. By keeping abreast of these developments, individuals can better plan and optimise their pension savings strategies.

Meanwhile, other financial changes are also taking place, with the National Living Wage increasing from £11.44 to £12.21 an hour from April 2025.

Estate Planning After April 2027

Estate Planning Changes Post-April 2027: Understanding the Impact on Pensions

From April 2027, significant changes are set to impact how pensions are treated within estate planning in the UK. Specifically, the majority of unused pension funds and death benefits will be included in the estate’s value for inheritance tax (IHT) purposes. This change aims to discourage individuals from using pensions as a tax-efficient way to transfer wealth upon death.

One of the key challenges arising from these alterations is the need for personal representatives to collaborate closely with scheme administrators. They’ll need to share information and calculate IHT liabilities accurately, working to strict deadlines to avoid late IHT payments.

To aid this process, the Government intends to provide an online calculator for personal representatives.

These changes will add considerable responsibilities to pension scheme administrators, necessitating revisions in their processes and communications to reflect the new requirements. The inclusion of pensions in the IHT net is expected to increase the IHT bill for many estates, particularly those with substantial pension benefits.

It is anticipated that the practical implications of these changes will become clearer following the current consultation, which is due to conclude on 22 January 2025. Until then, individuals with significant pension assets may need to revisit their estate planning strategies to ensure they’re optimised in light of these upcoming changes.

Tax Implications for Pension Inheritance

Understanding the Tax Implications of Inheriting a Pension: Key Changes to Estate Planning

From April 2027, the rules governing inheritance tax (IHT) on pensions are set to undergo significant changes, rendering it essential for individuals to reassess their estate planning strategies. Under the new rules, most unused pension funds and death benefits will be included in the estate for IHT purposes, marking a departure from the current treatment of pensions on death.

Presently, if an individual dies before reaching the age of 75, their unused pension funds can pass to beneficiaries without incurring IHT. However, if death occurs after 75, beneficiaries are required to pay income tax on withdrawals, albeit not IHT.

The forthcoming changes will mean that both IHT and income tax may be payable on the same pension funds, potentially leading to high effective tax rates of up to 91.46% in certain scenarios.

The inclusion of pensions in the estate will impact the availability of inheritance tax allowances, such as the residence nil rate band, which begins to taper when the estate value exceeds £2m. This could result in substantial increases in IHT liability for estates over £2m.

It’s important for individuals to review their existing pension and estate plans in light of these new rules to mitigate potential tax burdens. Consulting with a professional may provide valuable insights and help in managing these complexities effectively.

The impact of these changes will vary for different individuals, and it may be prudent to consider various strategies to optimise pension and estate planning. For example, individuals might consider drawing down their pension to generate surplus income, which could then be gifted under normal expenditure out of income rules, thereby potentially reducing IHT liabilities.

However, any decision should be made with careful consideration of individual circumstances and potential marginal tax rates.

Given the complexity of these changes, it’s critical for individuals to stay informed and consider seeking professional guidance to ensure their estate plans remain aligned with the new regulations. The consultation on these changes is ongoing until 22 January 2025, and it’s advisable for those who’ll be affected to monitor the developments closely and seek advice accordingly.

Planning for the New Rules

Planning for the New Inheritance Tax Rules on Pensions

Recent changes announced in the Budget will significantly impact how inheritance tax (IHT) is applied to pensions. From 6 April 2027, unused pension funds and death benefits will be included within an individual’s estate for IHT purposes, affecting approximately 8% of estates each year. This change underscores the need for thorough planning to mitigate potential IHT liabilities.

Understanding these new rules and their implications is essential for those with substantial pension pots. The inclusion of these funds in estate valuations could lead to a marked increase in IHT bills, particularly for estates that exceed the £2 million threshold, where the residence nil rate band begins to taper away.

For individuals who are married or in civil partnerships, it’s worth noting that transfers of unused pension funds between spouses and civil partners will remain exempt from IHT. However, for those who are unmarried or in long-term relationships without formal legal union, this exemption doesn’t apply, potentially leading to higher IHT liabilities.

Given these changes, it’s prudent for individuals to review their pension arrangements and estate planning strategies. Alternative means of estate planning, such as lifetime gifts and trusts, may become more appealing as a way to manage IHT burdens.

Accurate record keeping of pension funds and death benefits will also be vital for efficient IHT reporting and payment.

The role of scheme administrators in reporting and paying IHT to HMRC adds a new layer of complexity to the probate process. This could extend the timeline for beneficiaries to receive their inheritance, emphasizing the importance of clear and comprehensive planning.

While the full details of these changes are subject to consultation and further clarification, it’s evident that the inclusion of pensions in IHT calculations will necessitate a reevaluation of many individuals’ estate planning strategies.

Seeking professional advice from a financial adviser or tax consultant can provide tailored guidance to ensure estate plans are optimised for these new rules.

Conclusion

From April 2027, significant alterations to pension death benefits will necessitate a review of estate planning for many individuals. Most unused pension funds and death benefits will be subject to Inheritance Tax (IHT), potentially at a 40% rate. This change highlights the importance of reconsidering current arrangements to minimise tax implications for beneficiaries and ensure compliance with the new rules.

The abolition of the lifetime allowance in April 2024 further underscores the need for this review. Historically, the lifetime allowance and its associated charge played a critical role in determining how pension lump sums were taxed. However, with its removal and the introduction of new lifetime limits, such as the Lump Sum and Death Benefit Allowance (LSDBA), individuals must understand how these changes affect their pension planning.

Under the new rules, almost all lump sum death benefits will form part of the member’s estate for IHT purposes, regardless of whether they are paid at the trustees’ discretion. This includes payments such as death in service benefits from defined benefit schemes, pension protection lump sum death benefits, and trivial commutation lump sum death benefits. The exception to this is a charity lump sum death benefit, which remains exempt from IHT if paid to a qualifying charity.

Unused drawdown funds will also be brought within the scope of IHT, reflecting the government’s aim to remove the opportunity for individuals to use pensions as a vehicle for estate planning by passing on unused defined contribution funds tax-free. Dependents’ scheme pensions, however, will remain outside the member’s estate for IHT purposes.

Trustees and employers will need to update their processes and communications to reflect these changes. This includes ensuring that schemes can provide the necessary information to personal representatives and HMRC within a potentially short timeframe, such as two months from the notification of the member’s death, to facilitate the reporting and payment of IHT.

Understanding these changes is essential for anyone concerned with optimising their pension strategy to benefit their heirs. The new rules underscore the need for a comprehensive review of pension arrangements to ensure that all tax implications are considered and to guarantee compliance with the updated legislation.