This article explores using tax-free cash from a pension to pay off a mortgage. Increasing interest rates by the Bank of England have put pressure on those with debt and particularly large debt such as mortgages. We explore the use case of taking tax-free cash to pay off your mortgage and the disadvantages of using your personal pension in this way.

While using pension funds to pay off a mortgage can provide immediate relief from debt, there are several considerations to remember. This includes evaluating the long-term financial implications, such as the potential reduction in retirement income and the loss of investment growth within the pension fund. It is essential for individuals to carefully weigh these factors against their specific financial goals and circumstances before making a decision.

Additionally, alternative options, such as refinancing or downsizing, could offer more flexibility and potentially better outcomes in certain situations. Seeking professional advice from a qualified financial adviser is strongly recommended to ensure an informed decision that aligns with individual needs and objectives.

Background

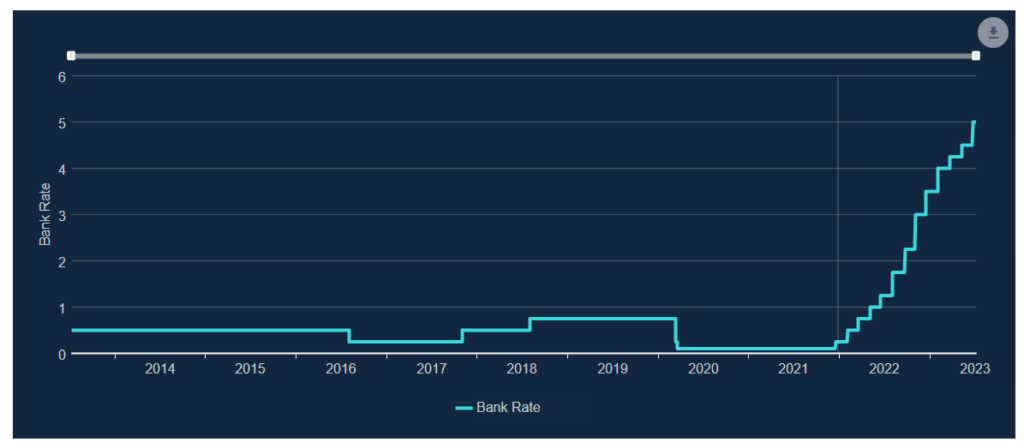

- Inflationary pressure has forced the Bank of England to increase the base rate at a rapid pace from 0.1% in December 2021 to 5% as of July 2023.

- Those coming off fixed mortgage rates are seeing a huge increase in their mortgage repayments.

- Borrowers are paying down their mortgage debt at a record rate, utilising any savings they have to reduce the new monthly mortgage outgoings.

- Those over 55 are being tempted to take money from their pension tax-free cash to pay off the mortgage.

Pension Withdrawal Options

Many are aware that a tax-free lump sum can be taken from their defined contribution or defined benefit pension from age 55.

The amounts can often be substantial and may certainly help reduce, if not pay off, a mortgage.

This strategy allows individuals 55 or older to access up to 25% of their defined contribution pensions as a tax-free lump sum. By using this lump sum from your pension to pay off a mortgage, individuals can reduce their monthly expenses and save on interest payments over time.

With a defined contribution pension, the remaining 75% of the fund can stay invested until retirement; however, taking a lump sum from your defined benefit pension will trigger the income to be paid. If you’re still working and don’t need this additional income, you may pay tax unnecessarily.

It’s important to consider the pros and cons of using this approach. On the one hand, paying off a mortgage can provide financial security and peace of mind. On the other hand, withdrawing pension funds early may result in reduced retirement income and limit future investment growth potential.

It’s crucial to consult with a financial advisor before making any decisions regarding pension withdrawal options.

Considerations for Using a Pension

Considering the potential limitations on pension benefits and the need for sufficient retirement funds to cover ongoing expenses, careful consideration should be given to utilizing funds from a pension for mortgage repayment purposes.

One of the main factors to consider is where you money is working hardest. Whilst interest rates were low, it was highly probable that money kept in pensions provided a better medium-term return. However, if the returns on your pension are expected to be less than the now inflated interest on your repayments, it may make sense to pay down some debt.

However, it is important to ensure that enough money will remain available in retirement to cover monthly outgoings, including mortgage payments if necessary. Additionally, assessing any restrictions on pension benefits that may arise from releasing a lump sum from the pension pot is crucial.

By weighing these factors, individuals can decide whether using their pension for mortgage repayment is suitable for their financial situation.

Impact on Retirement Income

The decision to utilize funds from a retirement plan, such as tax-free pension cash, to pay off a mortgage can significantly impact the overall income available during retirement. While it may provide immediate relief by eliminating mortgage debt, there are potential drawbacks.

Taking tax-free cash now means sacrificing future tax-free cash and any growth it could generate. This reduction in funds at retirement could result in a lower income stream for individuals later in life. It is important to think ahead and understand what your income needs may be when you retire. Putting together a cash flow forecast is a great way to visualise this. A cash flow forecast takes into account all your income/expenditure & savings/debt to estimate how long your savings may last throughout retirement.

Seeking professional advice from a financial adviser can help individuals make informed decisions based on their specific circumstances and goals.

Alternative Options

An alternative approach to taking money from your pension is to utilise any other savings you may have built up. Saving in premium bonds, bank accounts or cash ISA’s should first be considered before withdrawing from a pension.

Reviewing the way your pension is invested can also make financial sense. Many people start a pension and don’t review where it is invested until they take an income in retirement. Over time, pension funds and someone’s attitude to investment risk can become misaligned, meaning their fund may underperform expectations. Regularly reviewing where you are invested ensures realistic goals are met.

Seeking Professional Advice

Consulting with a financial advisor can give individuals valuable insights and guidance regarding retirement plans and investment strategies. A financial advisor would write objectively, professionally, presenting unbiased and factual information to help individuals make informed decisions about their finances.

When considering using tax-free pension cash to pay your mortgage, seeking professional advice is crucial. A financial advisor will assess various factors, such as the pension returns and the mortgage’s interest rate. They will build a cash flow forecast to understand the impact of this option on one’s future financial situation. This analysis will help individuals determine whether utilizing their tax-free lump sum for paying off their mortgage is financially advantageous or if alternative options may be more beneficial.

Overall, seeking professional advice before making decisions regarding pension funds and mortgages is important to make well-informed choices aligned with one’s long-term financial goals.

https://www.standardlife.co.uk/articles/article-page/rising-interest-rates-your-mortgage-pension

Frequently Asked Questions

What is pension tax-free cash and how does it work?

Pension tax-free cash, often referred to as the pension commencement lump sum (PCLS), is the portion of a pension pot which can be taken tax-free when you retire. In most cases, this is 25% of the total value of your pension savings. However, the exact percentage might vary depending on the type of pension scheme you are enrolled in.

Can I use my pension tax-free cash to pay off a mortgage if I have already retired?

Retirees can use their pension tax-free cash to pay off a mortgage. However, it is important to consider the potential implications, such as reducing retirement income and possible loss of investment opportunities.

Are there any tax implications if I use my tax-free pension cash to pay off a mortgage?

There are no tax implications to using pension tax-free cash to pay off a mortgage and the withdrawal is tax-free as long as the scheme rules are followed.

Should I consider potential investment returns before using my pension tax-free cash to pay off my mortgage?

Absolutely. Before making a decision, compare the cost of your mortgage debt (interest rate, term, etc.) with the potential returns you could get from keeping your money invested in your pension. If your pension investments could earn a higher return than the interest you’re paying on your mortgage, it may be more beneficial to leave your pension pot untouched.

What are the tax implications of using my pension tax-free cash to pay off my mortgage?

The first 25% of your pension can usually be taken tax-free. However, the remainder of your pension will be taxed as income. Depending on how much you take out and your other sources of income, this could push you into a higher tax bracket, resulting in a large tax bill.

Can withdrawing my tax-free cash early affect my retirement income?

Yes, it can. When you take a lump sum from your pension, the remaining pension pot will be smaller. This means that the income you can take from your pension in the future will be reduced. It’s also important to consider that life expectancy is increasing, and you need to ensure your pension pot lasts for your entire retirement.

What other factors should I consider before deciding to use my pension tax-free cash to pay off my mortgage?

You should consider your overall financial situation. Do you have other savings or investments you could use instead? Are there other debts with higher interest rates you should pay off first? Also, consider whether you might need the cash for emergencies or large expenses in the future. Lastly, it’s vital to consider your overall retirement plan and long-term financial goals. You may wish to consult with a financial advisor to make sure you’re making the best decision for your circumstances.

Conclusion

Deciding whether to use your pension tax-free cash to pay off your mortgage is a significant decision that requires careful consideration. While the immediate relief from mortgage debt may be tempting, especially in an environment of rising interest rates, it’s essential to assess the long-term implications of such a decision. The amount of cash in your pension is a crucial resource for your retirement, and early withdrawal can reduce your future income, leaving less money for your later years.

Paying off your mortgage with your pension means sacrificing potential investment growth in your pension fund, which might outweigh the benefits of paying off the mortgage debt. The future of your pension fund growth relies heavily on staying invested, which can be a more beneficial strategy over the long term.

It’s also worth noting that once you cash in your pension to pay off your mortgage, that lump sum is no longer in a tax-efficient environment. While the initial 25% taken as a tax-free lump sum might be appealing, remember that the remaining 75% of your pension pot could be taxed depending on when and how much you withdraw.

Moreover, using your pension to pay off your mortgage early could affect your eligibility for certain state benefits. For those under 75, it could also result in a reduction of your money purchase annual allowance.

Before using your pension to pay off debts, consider all available options. These could include downsizing, refinancing your mortgage, or overpaying your mortgage if your interest rate is high. You may also have other savings or investments that could be used to pay off your mortgage without affecting your retirement income.

Remember, everyone’s circumstances are different. A right decision for one person may not be right for another. Consult a financial advisor who can help you navigate these options, taking into account your specific circumstances and long-term financial goals.

Deciding to use your pension to help pay off your mortgage is a big decision. Some advantages and disadvantages need to be weighed. While you may enjoy the relief of paying off your mortgage, consider the impact on your retirement income and whether you could achieve better returns by leaving your pension invested. It’s vital to get the balance right between reducing your debts and securing your financial future.

In conclusion, using your pension to pay off a mortgage is a choice that should be made based on your personal financial situation, your attitude towards risk, and your long-term goals. Always seek professional advice before making such a decision.